BASICS

Risk management is the term applied to a logical and systematic method of establishing the context, identifying, analyzing, evaluating, monitoring, and communicating risks associated with any activity, function, or process in a way that will enable organisations to minimize losses and maximize opportunities. It’s too often treated as a compliance issue that can be solved by drawing up lots of rules and making sure that all employees follow them. Many such rules, of course, are sensible and do reduce some risks that could severely damage a company.

Risk management is as much about identifying opportunities as avoiding or mitigating losses.

Most organizations tend to look at Risk from the following perspective:

-

-

- Strategic

- Operations

- Market / External

- At times specific to certain function eg: Credit Risk

-

Apart from Strategic Risk, the rest tend to be compliance centric which calls for more attention towards the relevancy of it and should support the decision process. Meanwhile, Strategic Risk is the most challenging area to implement or execute in an organization.

Strategic Risk falls into 3 categories:

Category 1 :

Known knowns – focusing mostly from governance and compliance matters eg: Arise from employees’ failure to perform routine, standardised or predictable processes

Category 2 :

Known unknowns – What can cause us not to achieve the desired strategic objectives? Risks the organisation is willing to accept to execute the strategy and create value

Category 3 :

“Unknown unknowns:” What event or combination of events can cause the entire strategy or the enterprise to fail? Eg: black swan events

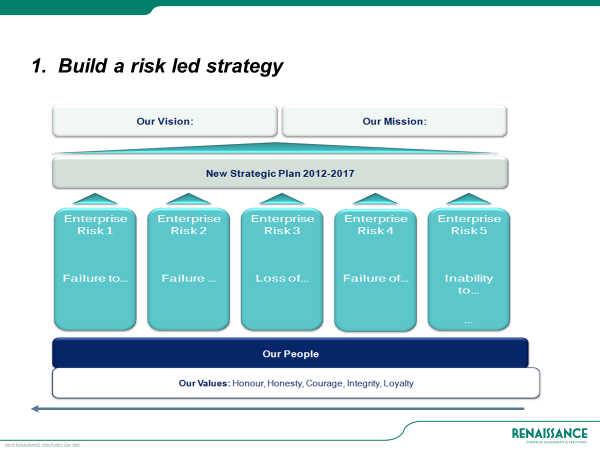

Risks exist within each element of strategy execution as well as the strategy, Failure to address these risks reduces performance and erodes the value creation of an organization.

Risk management is the term applied to a logical and systematic method of establishing the context, identifying, analyzing, evaluating, monitoring, and communicating risks associated with any activity, function, or process in a way that will enable organisations to minimize losses and maximize opportunities. It’s too often treated as a compliance issue that can be solved by drawing up lots of rules and making sure that all employees follow them. Many such rules, of course, are sensible and do reduce some risks that could severely damage a company.

Risk management is as much about identifying opportunities as avoiding or mitigating losses.

Most organizations tend to look at Risk from the following perspective:

- Strategic

- Operations

- Market / External

- At times specific to certain function eg: Credit Risk

Apart from Strategic Risk, the rest tend to be compliance centric which calls for more attention towards the relevancy of it and should support the decision process. Meanwhile, Strategic Risk is the most challenging area to implement or execute in an organization.

Strategic Risk falls into 3 categories:

Category 1 :

Known knowns – focusing mostly from governance and compliance matters eg: Arise from employees’ failure to perform routine, standardised or predictable processes

Category 2 :

Known unknowns – What can cause us not to achieve the desired strategic objectives? Risks the organisation is willing to accept to execute the strategy and create value

Category 3 :

“Unknown unknowns:” What event or combination of events can cause the entire strategy or the enterprise to fail? Eg: black swan events

Risks exist within each element of strategy execution as well as the strategy, Failure to address these risks reduces performance and erodes value creation of an organization.

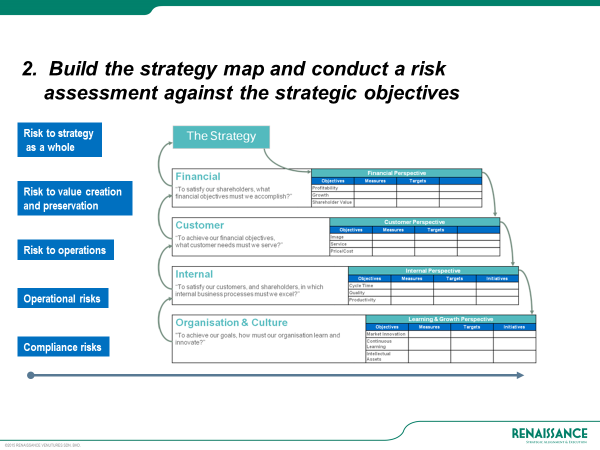

Two approaches to integrating Strategy and Risk

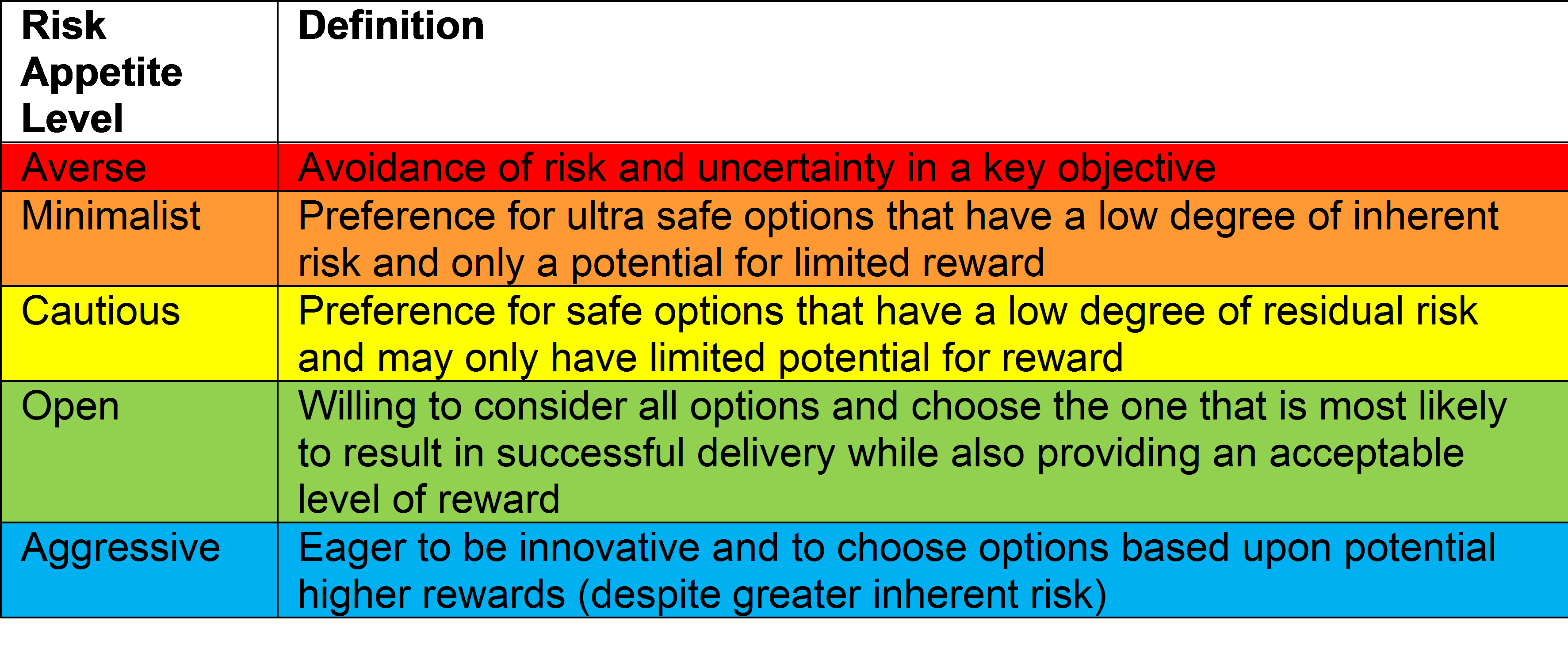

All organization recognises that there is an element of risk in all commercial activity, Risk Appetite or the amount of risk the organisation is prepared to take in pursuit of its strategic objectives is necessary to be identified. The below table provides an example of Risk Appetite.

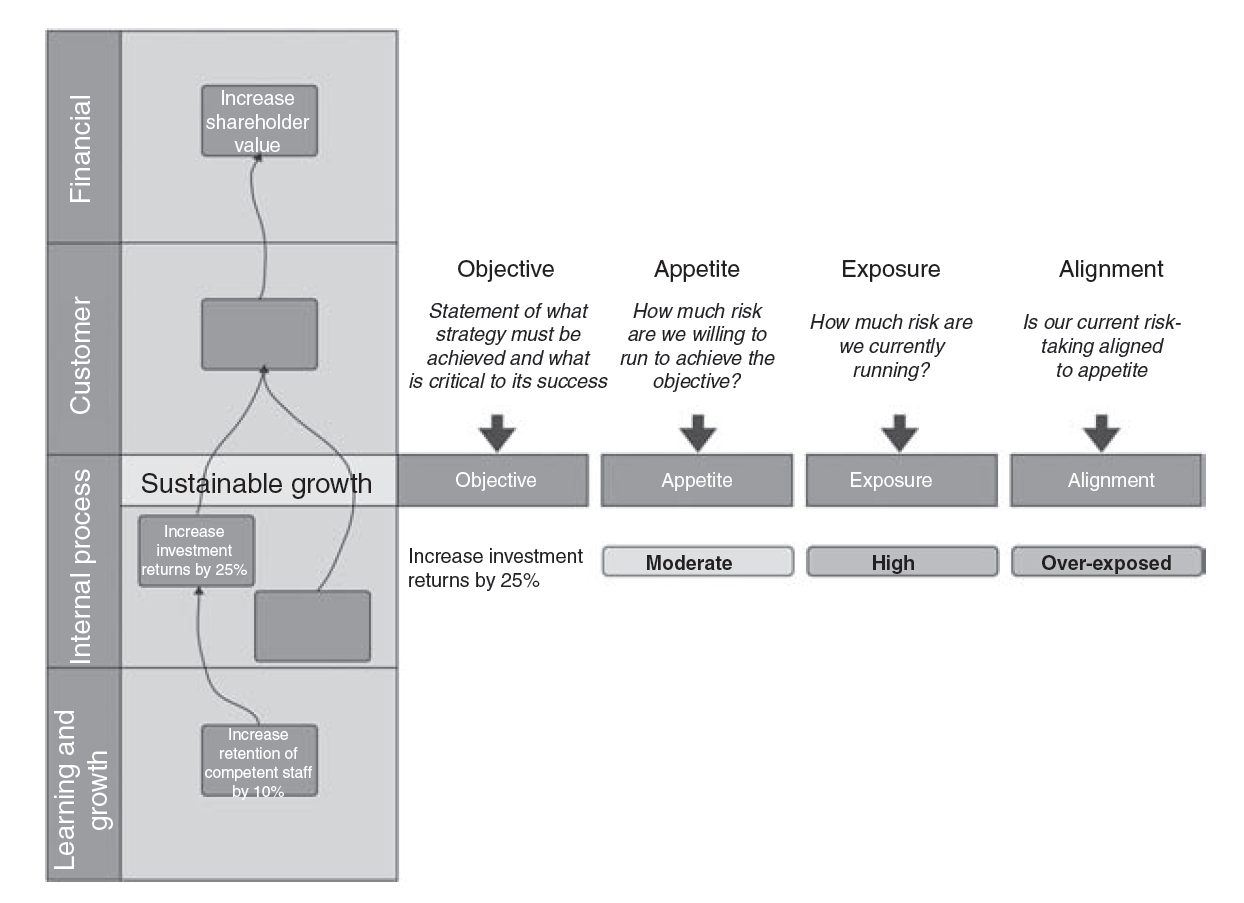

Strategic performance management requires ongoing risk assessments – it is a process, not an event. Strategic risk should be quantified wherever possible. Based on our implementations it necessary to keep the entire process Simple & Real!

Written By

TM Nagarajan/Managing partner